INSURANCE ROADMAP 2023 - 2027

The Indonesian Financial Services Authority (OJK) has released a roadmap for the development and strengthening of Indonesian insurance industry 2023-2027.

The roadmap is developed in response to the escalating challenges faced by insurance industry in Indonesia. In 2022, OJK received 1,291 complaints in contrast to only 22 complaints recorded in 2018. It is an indication of yearly increase in the number of recorded complaints. These challenges have the potential to erode public trust in the insurance industry. This also highlights the urgent need to enhance consumer education and improvement in market behaviour.

With this roadmap, it is hoped that stakeholders can synergise in developing the insurance industry. This will result in a healthy, efficient, and integrity-driven sector, strengthening consumer and community protection and support to national economic growth.

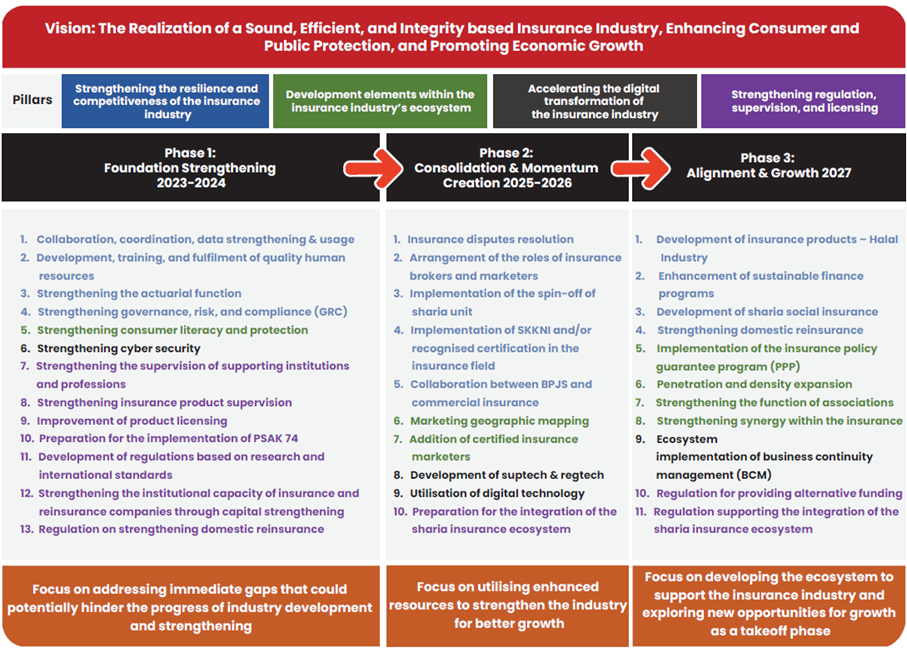

Highlighted areas in the roadmap implementation include capital strengthening, governance, risk management, and regulations to support professional services and products in the insurance industry. In broad strokes, the roadmap is depicted in the following framework.

This roadmap presents a clear vision for the future of the insurance industry in Indonesia. This collaborative strategic program requires commitments from all stakeholders to implement effective and focused measures to develop the insurance industry in the coming years. Through initiatives to enhance capital, this ensures industry sustainability, improved governance, and trust in the financial services sector. It is expected that better protection for the industry and society will be achieved, along with increased public confidence.

As part of professional supporting services in the insurance industry, we commit to contribute in the process of building a sound, efficient, and trustworthy insurance industry in line with this roadmap to create an industry that is competitive and towards a brighter future.